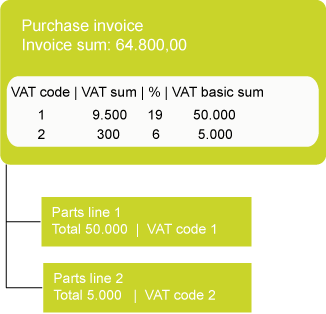

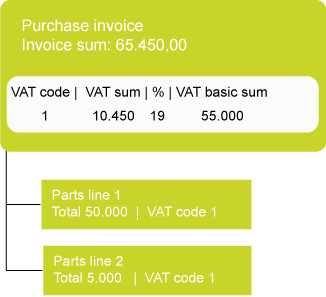

Use the VAT sums form to modify the VAT sums on purchase invoices. You may do so if you receive a purchase invoice to which more than one VAT code applies. In that case, you specify, for example, that in addition to a purchase invoice line subject to the regular rate, there is also a line that is subject to the low VAT rate. To do so, add a VAT sum line. When you save this line, the VAT basic sum (the sum exclusive of VAT) of the added line will be calculated automatically.

The total VAT sum specified on the purchase invoice may consist of more than one VAT line:

Note: If you open this form from the Permanently processed purchase invoices form, the VAT data are informational and cannot be changed.

Example 1

Example 2